Pengertian Earnings Per Share (EPS)

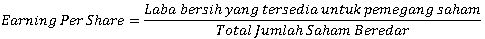

Earnings per share (EPS) adalah rasio kunci yang digunakan untuk menentukan porsi pendapatan pemegang saham biasa (common stock) dari laba perusahaan. Laba per saham mengukur alokasi laba setiap saham biasa dalam kaitannya dengan total laba perusahaan.

Diketahui laporan laba rugi PT. ABC tahun 2018 adalah sebagai berikut :.

Earnings Per Share = (Laba operasi - (bunga+pajak) ) / jumlah saham beredar.

= ((penjualan - HPP - beban usaha - depresiasi - amortisasi) - (bunga+pajak))

/jumlah saham beredar.

Earnings Per Share = ((7.000.000.000 - 4.000.000.000 - 1.000.000.000 - 100.000.000 - 50.000.000 - 1.000.000.000) - (150.000.000+170.000.000)) / 1.000.000.000.

Earnings Per Share = 1.530.000.000 / 1.000.000.

Earnings Per Share = Rp. 1.530,-.

Sumber :.

Gitman, Lawrence, J dan Chad J. Zutter. 2015. Principles of Managerial Finance Brief 7th Edition. Boston: Prentice Hall.

|

| Rumus EPS. |

1. Kajian Pustaka Earnings Per Share.

1.1 Pengertian Earnings Per Share.

"Corporations commonly measure profits in terms of earnings per share (EPS), which represent the amount earned during the period on behalf of each outstanding share of common stock. EPS are calculated by dividing the period’s total earnings available for the firm’s common stockholders by the number of shares of common stock outstanding." (Lawrence J. Gitman dan Chad J. Zutter, 9:2015).1.2 Landasan Teori Earnings Per Share.

"EPS represent the number of dollars earned during the period on behalf of each outstanding share of common stock." (Lawrence J. Gitman dan Chad J. Zutter, 55:2015).1.3 Penggunaan EPS Untuk Menghitung Pendekatan P/E Multiple.

"The price/earnings multiple approach is a popular technique used to estimate the firm’s share value; it is calculated by multiplying the firm’s expected earnings per share (EPS) by the average price/earnings (P/E) ratio for the industry. The average P/E ratio for the industry can be obtained from a source such as Standard & Poor’s Industrial Ratios." (Lawrence J. Gitman dan Chad J. Zutter, 277:2015).1.4 Hubungan Financial Leverage Terhadap Earnings Per Share.

"Financial leverage is concerned with the relationship between the firm’s EBIT and its common stock earnings per share (EPS). On the income statement, you can see that the deductions taken from EBIT to get to EPS include interest, taxes, and preferred dividends. Taxes are clearly variable, rising and falling with the firm’s profits, but interest expense and preferred dividends are usually fixed. When these fixed items are large (that is, when the firm has a lot of financial leverage), small changes in EBIT produce larger changes in EPS." (Lawrence J. Gitman dan Chad J. Zutter, 466:2015).2. Cara Menghitung Earnings Per Share.

Diketahui laporan laba rugi PT. ABC tahun 2018 adalah sebagai berikut :.

- penjualan sebesar Rp. 7.000.000.000,-.

- harga pokok penjualan sebesar Rp. 4.000.000.000,-.

- beban penjualan, pemasaran, administrasi dan umum sebesar Rp. 1.000.000.000,-.

- beban penyusutan bangunan sebesar Rp. 100.000.000,-.

- beban penyusutan mesin sebesar Rp. 50.000.000,-.

- beban bunga sebesar Rp. 150.000.000,-.

- beban pajak sebesar Rp. 170.000.000,-.

- saham beredar 1.000.000 lembar saham.

Earnings Per Share = (Laba operasi - (bunga+pajak) ) / jumlah saham beredar.

= ((penjualan - HPP - beban usaha - depresiasi - amortisasi) - (bunga+pajak))

/jumlah saham beredar.

Earnings Per Share = ((7.000.000.000 - 4.000.000.000 - 1.000.000.000 - 100.000.000 - 50.000.000 - 1.000.000.000) - (150.000.000+170.000.000)) / 1.000.000.000.

Earnings Per Share = 1.530.000.000 / 1.000.000.

Earnings Per Share = Rp. 1.530,-.

Sumber :.

Gitman, Lawrence, J dan Chad J. Zutter. 2015. Principles of Managerial Finance Brief 7th Edition. Boston: Prentice Hall.

Komentar

Posting Komentar